In Times Of Crisis and Price Cuts, How Can Factoring Help Oil Businesses Stay Afloat

Introduction

When times get tough in America companies are often faced with difficult decisions. From deciding which employees to let go of deciding how to get the bills paid there are so many considerations. But what if there was an easier way to get through the hard times. One little talked about option is the option of factoring. What is factoring? How can it help you get your business through a hard time? Can it help me even in the oil industry that is heavily dependent on the market? Consider all these things.

What is Factoring?

Factoring is essentially selling future invoices. It is the promise of doing the work to pay the invoices to a third party company. In return, they give you the cash to operate on right then and there. Basically, a third party company with the cash in hand offers to wait on your money. That way you can have the cash that you are in desperate need to keep the company moving forward. This is a great option for companies that have to wait for their money until the work is done. For example construction and oil field services.

Things to Consider

There are three major things that are important to know and think about before agreeing to a factoring agreement. These things are factoring rate, the advance and the time span of the factoring period. After finding out these three numbers you have to utilize them to do the math to ensure that you are getting a good rate. Factoring companies are kings for giving people terrible deals simply because they are desperate. So even in desperate and terrible times be sure that you are shopping around and doing your due diligence to ensure that you are getting a safe and fair deal.

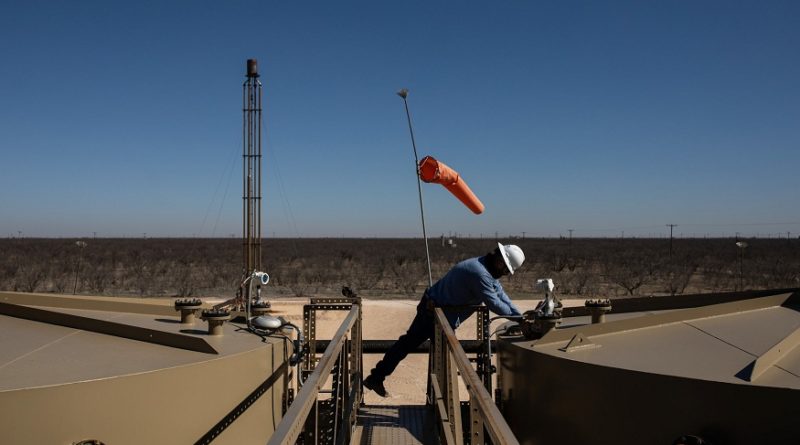

Specifics to the Oil Industry

The major benefit of oilfield factoring is that you can turn future assets into immediate capital. The oil industry is heavily dependent on the stock market. So when the stocks on oil crash the companies have a hard time surviving. And despite popular belief, the oil companies typically don’t have a ton of cash on hand. This is because even though they make the big bucks they also have to spend the big bucks. The major-specific to the oil industry benefits of factoring is that there is immediate payment. This immediate cash can help pay for everything from equipment to paychecks. Along with that there is not interest or limits on spending. Because basically the cash is your cash. You just haven’t earned or gotten paid yet. So it is basically like a business cash advance.

Getting Through Hard Times

Market failures are especially hard on large oil industry companies. The current world market relies heavily on politics. So the oil industry really never stabilizes. Because right about the time you think it is stable something else happens politically such as the Coronavirus or a major presidential office change. So the oil industry typically is either suffering really hard times or really good times. Despite the good times, the expenses pile up making it difficult to get through the hard times. Factoring can be a good option to help large oil companies get through large political changes.

Conclusion

In the end, the large political changes that happen in the world greatly affect the oil industries. This is why oil companies choose to factor to help get the cash on hand that they need to survive. There are many factors involved in oil company factoring. From the rate, advance and time span factoring there is much to consider in oilfield factoring.